The purpose of comparing actual vs. Taking appropriate corrective action 4.

How Plan Vs Actual Comparison Helps You Manage Your Business

Management uses budget reports to analyze differences between actual and planned results and determine their causes.

. Budget reports comparing actual results with planned objectives should be prepared weekly to be most effective. Comparison between actual results and budgets are made to. As a result of analyzing budget reports management may either or modify future plans.

Management uses budget reports to analyze differences between actual and planned results and determine their causes. Budget reports compare actual results with planned objectives True All budget reports should be prepared weekly False management Uses budget reports to analyze differences between actual and planned results and determine their causes True As a result of analyzing budget reports management may either take corrective action or modify future plans. Here are five key benefits of a budget vs actual variance analysis.

Start A Free Trial With Ramsey Start Hitting Your Money Goals Today. All budget reports are prepared on a weekly basis. Budget reports compare actual results with planned objectives.

Connie Rice has prepared the following list of statements about budgetary control. Management uses budget reports to analyze differences between actual and planned results and determine their causes. All budget reports are prepared on a weekly basis.

True Identify each statement as true or false. Budget is to add value to the business through better planning monitoring evaluating and controlling. Well essentially you compare your predicted budget projections to what the real-world numbers are showing.

Budget reports comparing actual results with planned objectives should be prepared only once a year. Compare top budgeting apps. Budget reports comparing actual results with planned objectives should be prepared weekly to be most effective.

Based on the precision desired the financeaccounting team will detail out variances in major revenue COGS and expense categories and will obtain explanations from both inside and outside of the finance and accounting team. All budget reports are prepared on a weekly basis. Management uses budget reports to analyze differences between actual and planned results and determine their causes.

Monthly bill tracking FICO scores and integration options. The Budget vs Actuals report shows you how well you are meeting your original goals for the year for top-line sales and line-by-line expenses. Budget reports compare actual results with planned objectives.

Management uses budget reports to analyze differences between actual and planned results and determine their causes. -difference between actual and planned results 2. Preparing periodic budget reports that compare actual results with planned objectives 2.

Analyze the difference to determine their causes 3. You find a difference between what was expected and what is happening thats considered a variance. If a variance analysis renders a set of results that create large variances throughout the report it might be an indication there are significant issues with the way the budget is being prepared.

Ad Personal finance planning. Budget reports compare actual results with planned objectives. True False Cash budget reports are often prepared daily whereas others are prepared less frequently depending on the activities being monitored.

Budget reports compare actual results with planned objectives. 10 rows Connie Rice has prepared the following list of statements about budgetary control. Improve next times budget.

The goal obviously is to have as few or as small a variance as possible. The issues might relate to the use of bad data. Investigate only material and controllable exceptions express materiality as a percentage difference form budget - controllability relates to those items controllable by the manager.

As a result of analyzing budget reports management may either or modify future plans. 1499 Description Similar Products Also Viewed Product Description. In these analyses the financeaccounting team will compare budget to actual or forecast to actual for the month and for the year to date.

On the basis of the budget reports a management analyzes differences between actual and planned results. The Budget vs Actuals Report is your reality check for how close you are to your goals for the year. All budget reports are prepared on a weekly basis.

Save money with a personal budget app. Focus of top managements review of a budget report. What does this mean.

Ad Take Your Budget Anywhere Track Your Money Develop Better Spending Habits. For each line you can compare your budgeted amounts against your actual income and expenses. Able to focus on problem areas 3.

Budgetary Control and Variance. If actual results are different from planned results the difference must always be. For example if costs are higher than expected management action might be able to bring them back into line.

Budget reports comparing actual results with planned objectives should be prepared only once a year. Budget reports compare actual results with planned objectives. Budget reports compare actual results with planned objectives.

All budget reports are prepared on a weekly basis. False Identify each statement as true or false. Management may adjust a budget upward or downward to better reflect reality and implement new cost-cutting or sales-promoting measures.

True False Cash budget reports are often prepared daily whereas others are prepared less frequently depending on the activities being monitored. Budget reports comparing actual results with planned objectives should be prepared only once a. The purpose of making comparisons.

- Provides definite objectives for evaluating performance - Helps motivate personnel. Budget reports comparing actual results with planned objectives should be prepared only once a year. True or False All budget reports are prepared on a weekly basis.

Connie Rice has prepared the following list of statements about budgetary control. If budgets are not met then managers might have underperformed.

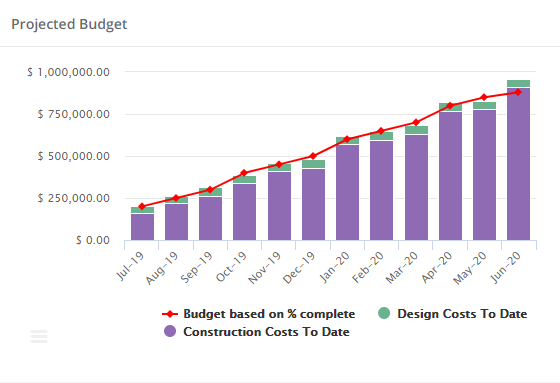

Budget Vs Actual Dashboard Clearpoint Strategy

Budget Vs Actual Dashboard Clearpoint Strategy

How Plan Vs Actual Comparison Helps You Manage Your Business

How Plan Vs Actual Comparison Helps You Manage Your Business

0 Comments